Creditor Harassment Attorneys in St. Petersburg, Florida

Florida Attorneys

Serving You and The State of Florida

Debt collectors in Florida use aggressive tactics, constant phone calls, threats of arrest, calls to your workplace, and intimidation that violate federal and state consumer protection laws. The Fair Debt Collection Practices Act (FDCPA) and Florida Consumer Collection Practices Act (FCCPA) prohibit abusive, deceptive, and harassing debt collection practices, and you have the right to fight back when collectors break these rules.

Lopez Law Group represents clients in St. Petersburg, Bradenton, and throughout Pinellas and Manatee County who face illegal creditor harassment. Our St. Petersburg creditor harassment attorneys stop collection calls, pursue damages against debt collectors who violate the law, and protect your rights under federal and Florida consumer protection statutes.

Whether you’re dealing with medical debt, credit card collections, or threats of wage garnishment, our consumer protection attorneys hold debt collectors accountable. Contact us now to schedule your consultation.

Table of Contents

- Why Choose Lopez Law Group for Creditor Harassment Cases in St. Petersburg?

- What Is Creditor Harassment Under Florida and Federal Law?

- Can I Sue a Debt Collector for Harassment in St. Petersburg, FL?

- How Do I Prove Creditor or Debt Collector Harassment?

- Do I Have to Keep Paying If the Collector Broke the Law?

- Will Filing Bankruptcy Stop Creditor Harassment Calls?

- Do I Need a Lawyer to Stop Creditor Harassment, or Can I Handle It Myself?

- FAQ for Creditor Harassment in St. Petersburg

- Stop Creditor Harassment with a St. Petersburg Consumer Protection Attorney

Why Choose Lopez Law Group for Creditor Harassment Cases in St. Petersburg?

Our approach starts with documenting every violation. We review call logs, voicemails, text messages, letters, and emails to identify specific FDCPA and FCCPA violations, then send demand letters to collection agencies outlining the violations and damages owed.

Our creditor harassment lawyers in Florida can:

- Review of all communication records to identify FDCPA and FCCPA violations

- Demand letters to debt collectors outlining violations and damages

- Negotiation of settlements that include damages and cessation of all collection activity

- Filing lawsuits in federal court or Florida circuit court when necessary

- Representation at hearings and trials to prove violations and recover damages

- Post-judgment enforcement to collect damages awarded by the court

Many cases settle quickly once collectors realize they violated federal law and face liability for statutory damages and attorneys’ fees. When settlement negotiations fail, we file lawsuits in federal and state courts to hold collectors accountable.

Consultation fees apply for consumer protection and creditor harassment matters. Call (727) 933-0015 to schedule a consultation with Lopez Law Group in St. Petersburg and take the first step toward stopping illegal debt collection harassment.

What Is Creditor Harassment Under Florida and Federal Law?

The FDCPA applies to third-party debt collectors, including collection agencies, debt buyers, and attorneys who regularly collect debts on behalf of others. The FCCPA applies more broadly to original creditors, collection agencies, and anyone attempting to collect consumer debts in Florida.

Both laws prohibit:

- Repeated or continuous phone calls intended to annoy, abuse, or harass the person who answers. Collectors who call multiple times per day, call back-to-back, or call early in the morning or late at night violate federal and Florida law.

- Calls before 8 a.m. or after 9 p.m. in your time zone. The FDCPA restricts the hours during which debt collectors may contact you, recognizing that calls outside normal hours are harassing and intrusive.

- Calls to your workplace after you tell them to stop. If you inform a debt collector that your employer prohibits personal calls or that you cannot receive collection calls at work, the collector must stop calling your workplace.

- Threats of arrest, violence, or criminal prosecution. Debt collectors cannot threaten you with arrest for unpaid debts, suggest they will physically harm you, or falsely claim that failing to pay a debt is a crime.

- Profane, obscene, or abusive language. Name-calling, cursing, and verbal abuse violate the FDCPA and FCCPA, regardless of how frustrated the collector might be about your inability to pay.

- False or misleading statements about the debt or your legal obligations. Collectors cannot lie about the amount you owe, falsely claim to be attorneys or government officials, threaten lawsuits they have no intention of filing, or misrepresent your legal rights.

- Contacting third parties about your debt. Debt collectors cannot discuss your debt with your family, friends, neighbors, or coworkers except to locate you. They may contact third parties once to obtain your phone number, address, or place of employment, but they cannot reveal that you owe a debt.

- Continuing to contact you after you send a written cease communication letter. Once you send a written request for the collector to stop contacting you, they may only contact you once to confirm they will stop or to notify you of specific actions like filing a lawsuit.

Can I Sue a Debt Collector for Harassment in St. Petersburg, FL?

Yes, you may sue debt collectors who violate the FDCPA or FCCPA in federal court or Florida circuit court. The FDCPA allows consumers to file lawsuits within one year of the violation, while the FCCPA allows lawsuits within one year under the specific statute or up to four years under general Florida law depending on the nature of the claim.

Successful FDCPA and FCCPA lawsuits could result in:

- Statutory damages up to $1,000 per lawsuit under the FDCPA. Florida courts may award additional statutory damages under the FCCPA depending on the severity and frequency of violations.

- Actual damages for emotional distress, lost wages, medical expenses, or other harm caused by the illegal harassment. Courts award actual damages based on evidence of the impact the harassment had on your life, health, and employment.

- Attorneys’ fees and costs. The debt collector pays your attorney’s fees if you win, which allows consumer protection attorneys to represent clients on contingency. You don’t pay attorney’s fees out of pocket, and the collector’s liability for fees creates strong leverage during settlement negotiations.

- Injunctive relief requiring the debt collector to stop contacting you and delete your information from their systems.

Many FDCPA and FCCPA cases settle before trial because debt collectors face liability for statutory damages and attorneys’ fees even if they only violated the law once. Settlement amounts vary based on the number and severity of violations, the harm caused, and the collector’s willingness to negotiate.

How Do I Prove Creditor or Debt Collector Harassment?

Proving creditor harassment requires documentation of the collector’s conduct, the frequency and timing of calls, the content of voicemails and letters, and evidence that the collector violated specific provisions of the FDCPA or FCCPA. Strong evidence includes:

Phone Records

Phone records showing the date, time, and frequency of collection calls. Your cell phone bill or call log proves how many times the collector called, whether calls occurred before 8 a.m. or after 9 p.m., and whether the collector called your workplace.

Voicemails

Voicemails containing threats, profanity, false statements, or other illegal content. Save every voicemail the collector leaves, even brief messages like “call us back immediately,” contribute to proving a pattern of harassment.

Text Messages and Emails

Text messages and emails from the debt collector. Written communications often contain false statements about the debt, threats of legal action, or other FDCPA and FCCPA violations.

Collection Notices

Letters and notices sent by the debt collector. Collection letters must include specific disclosures required by federal law. Letters that fail to include required notices, contain false statements, or threaten illegal actions violate the FDCPA and FCCPA.

Witness Statements

Witnesses who heard calls, observed your distress, or received calls from the debt collector. Family members, coworkers, or friends who witnessed harassment or received improper calls from collectors provide valuable testimony.

Cease Communication Letter

Your cease communication letter sent via certified mail, return receipt requested. The certified mail receipt and return receipt prove the collector received your written request to stop contacting you, making any subsequent calls violations of federal law.

Lopez Law Group reviews all evidence of harassment, identifies specific FDCPA and FCCPA violations, and builds cases that hold debt collectors accountable.

Do I Have to Keep Paying If the Collector Broke the Law?

Many debt collectors settle harassment cases by agreeing to:

- Pay statutory and actual damages for FDCPA and FCCPA violations

- Delete the debt from your credit report

- Waive or reduce the amount you owe

- Stop all collection activity and sell or return the debt to the original creditor

Lopez Law Group negotiates comprehensive settlements that address both the harassment violations and the debt, giving you relief from collection calls and reducing or eliminating your financial obligation. We have a strong track record of client satisfaction, helping St. Petersburg residents with a wide range of legal matters.

Will Filing Bankruptcy Stop Creditor Harassment Calls?

Yes, filing bankruptcy immediately stops all creditor harassment through the automatic stay, a federal court order that prohibits creditors from calling, sending letters, filing lawsuits, or continuing any collection activity. The automatic stay takes effect the moment you file bankruptcy and remains in place throughout your case.

Creditors who violate the automatic stay by continuing to contact you after you file bankruptcy face contempt sanctions, fines, and liability for damages.

Lopez Law Group handles both consumer protection cases and bankruptcy matters, advising clients on whether bankruptcy is the right solution for stopping creditor harassment and resolving overwhelming debt.

Do I Need a Lawyer to Stop Creditor Harassment, or Can I Handle It Myself?

Debt collectors know that most consumers won’t hire attorneys or file lawsuits, so they continue harassing people even after receiving cease communication letters. When you hire an attorney, collectors understand they face real liability. Attorneys also pursue damages for past violations, turning harassment into financial recovery rather than simply asking collectors to stop.

Our creditor harassment attorneys at Lopez Law Group understand that you are facing challenging financial times. We have open and transparent discussions about our fee structure and what you can expect for your specific case type.

FAQ for Creditor Harassment in St. Petersburg

Can Debt Collectors Contact My Family or Employer About My Debt?

Debt collectors may contact third parties once to obtain your phone number, address, or place of employment, but they cannot reveal that you owe a debt or discuss your financial situation. Collectors who tell your employer, family members, or neighbors about your debt violate federal and Florida law.

How Do I Send a Cease Communication Letter to a Debt Collector?

Send a written letter via certified mail, return receipt requested, stating that you want the debt collector to stop contacting you. Keep copies of the letter and the certified mail receipt. Once the collector receives your letter, they may only contact you to confirm they will stop or to notify you of specific legal actions, like filing a lawsuit.

What Happens if a Debt Collector Sues Me After I Send a Cease Communication Letter?

Sending a cease communication letter does not prevent a debt collector from filing a lawsuit to collect the debt. If the collector files a lawsuit after receiving your cease letter, they may contact you once to notify you of the lawsuit, and you will receive official court documents through service of process.

Can a Debt Collector Call Me at Work in Florida?

Debt collectors may call your workplace unless you tell them your employer prohibits personal calls or that you cannot receive collection calls at work. Once you inform the collector that you cannot take calls at work, they must stop calling your workplace or face liability for FDCPA and FCCPA violations.

Can I Be Arrested for Not Paying Credit Card Debt or Medical Bills in Florida?

No, you cannot be arrested for failing to pay credit card debt, medical bills, or other consumer debts in Florida. Unpaid consumer debts are civil matters, not criminal offenses, and debt collectors who threaten you with arrest are violating federal and Florida law.

Stop Creditor Harassment with a St. Petersburg Consumer Protection Attorney

SeanCarlo Lopez, St. Petersburg Creditor Harassment Attorney

Illegal debt collection harassment violates federal and state consumer protection laws, and you have the right to fight back when collectors use threats, intimidation, or abusive tactics to collect debts. Understanding your rights under the FDCPA and FCCPA gives you the foundation to hold debt collectors accountable and recover damages for violations.

Lopez Law Group offers consultations for creditor harassment and consumer protection matters in St. Petersburg, Bradenton, and throughout Pinellas and Manatee County. We review your evidence, identify violations, and pursue maximum recovery through settlement negotiations or litigation.

Call (727) 933-0015 to speak with a St. Petersburg creditor harassment attorney who understands the FDCPA, FCCPA, and the strategies that stop illegal debt collection. Schedule your consultation today. Consultation fees apply for consumer protection and creditor harassment services.

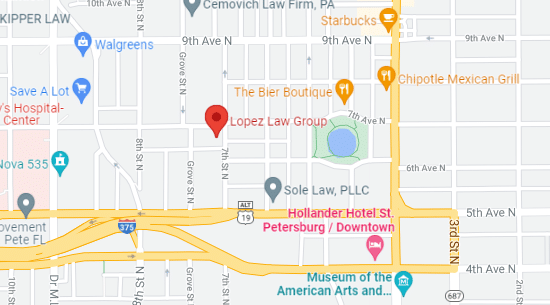

Lopez Law Group – Office

700 7th Ave N Suite A,

St. Petersburg, FL 33701

Ph: (866) 256-2356

Practice Areas

What Our Clients Say

A Godsend

Mr. Lopez was a Godsend and really helped me with my situation. Him and the entire firm were very diligent and helped speed the early stages of the process along due to a pressing situation. Throughout my experience working with the firm, they were always responsive and available any time I had a question or wanted to check on the state of affairs. Hopefully I won’t have to recommend Lopez Law Group to my friends or family, but if those unfortunate circumstances arise then there’s only one name I would trust. Thank you again for all your help!

Lopez Law Group Can See You Through Cases Like:

Don't See What You Need?

Lopez Law Group

700 7th Ave N, Suite A,

St. Petersburg, FL 33701

P: 727-933-0015

Business Hours

Mo, Tu, We, Th, Fr

Schedule a Call Back

Book a Consultation