Creditor Claims in Probate

Florida Attorneys

Serving You and The State of Florida

On the death of a loved one, family members and close friends experience a range of emotions. During this time, it is easy for them to become overwhelmed or frustrated by the procedure of settling the deceased’s estate. When several creditors or debts are casting a shadow, working with an experienced probate attorney may be beneficial in this situation.

The Lopez Law Group has represented several estates with multiple creditor lawsuits and estates deemed insolvent so that their liabilities don’t outweigh the assets.

We work with families to keep as many assets as possible and ensure that estate assets cover administration costs rather than trustees paying them out of pocket. There are several options for protecting properties from potential creditors, including:

- Objecting to creditor claims

- Homestead evaluation for real property

- Exempt private property under Florida law

- Appealing for claim reduction directly with the creditor

What Is A Creditor Claim in Florida?

Under Florida probate, a creditor claim is a suit filed by an individual or organization (a “creditor”) from whom the deceased person borrowed from before death. To seek a creditor’s claim’s satisfaction, a creditor must file a timely claim during the estate’s probate.

Unless you block creditors’ claims, a personal representative should publish and serve notice to creditors according to Section 733.701 of the Florida Statutes.

How Do I Handle A Probate Procedure?

Probate is a method of taking an organized inventory of a deceased person’s properties, paying creditors, and transferring all remaining assets to the beneficiaries of a will or legitimate heirs if no will exists. Under most circumstances, the probate court located in the county where the decedent lived will oversee the probate process.

Some properties are not subject to the probate process, for example, retirement accounts and living trusts. However, probate is the only proper way to pass possession of such properties to heirs and beneficiaries legitimately.

If there is a will, probate starts with filing a petition in probate court to name an executor, or if there is no will, an administrator. This individual, also known as a personal representative, takes an inventory of the probate estate properties, notifying creditors and heirs and paying the decedent’s debts, taxes, and funeral costs.

The distribution of inheritances to heirs and descendants is the last step. Probate can take eight to twelve months to complete. However, for a straightforward estate, the process can move faster.

Probate in Florida: Who Gets Paid and In What Order?

Section 733.707 of the Florida Statutes governs the order in which a personal representative pays expenses and liabilities in a probate estate.

There are eight categories. Where there are many claims or the decedent’s assets do not cover all debts, they compensate the debts in the order listed below.

- Class 1.-Expenses of administration, costs, compensation of the personal representative, and their attorney’s fees can be awarded under Section 733.106 (3)

- Class 2.-Reasonable costs of the funeral, interment, and grave marker, whether paid by a beneficiary, guardian, Personal Representative, or any other person, to exceed a total of $6,000

- Class 3.-Taxes and debts with preference under federal law, claims under Section 409.9101 and 414.28, and claims in favor of the state for unpaid court costs, fees, or fines

- Class 4.-The reasonable and necessary medical and hospital expenses of the last 60 days of the decedent’s last illness, including compensation of persons providing care to the decedent

- Class 5.-Family allowance.

- Class 6.-Arrearage from court-ordered child support.

- Class 7.-Debts gained after death by the continuation of the decedent’s business followings. Section 733.612(22), but only to the extent of the assets of that business.

- Class 8.-All other claims against the estate, including those founded on decrees or judgments rendered against the decedent during their lifetime, and any excess over the amounts allowed in paragraphs (b) and (d)

How Do I File a Claim Against a Deceased Person’s Estate?

To file a claim against an estate, you must first confirm that the deceased owes the debt and then complete and file a claim form. If your claim is not filed correctly, the court may dismiss it.

However, before transferring properties to heirs, the estate must pay off any remaining debts.

Any creditor may file a claim against the estate if the decedent owed money at the time of their death. Although this may be a complicated process, creditors deserve every chance to have a debt reimbursed, so it might be better to seek professional help to help you receive payment of the debt.

Locate the Proper Probate Court

The probate court addresses cases surrounding a deceased person’s assets and future lawsuits over unpaid debts, issues with heirs, etc.

Probate proceedings may take place in a variety of courts. For example, the estate’s beneficiary or personal representative will apply for probate in the county where the decedent lived or owned land. As a result, it’s helpful to know where the deceased’s estate is being probated.

You may need to contact various courts and include the decedent’s name to determine which court will resolve your claim against the assets. The Lopez Law Group can help identify the court handling the estate against which you have a claim.

Confirm the Debt

Before you can sue the estate, you should first collect evidence showing the debt exists. If you have a promissory note, a payment, or another contract, keeping this paperwork at hand helps ensure that the probate court will approve your argument.

Remember that if you do not have evidence of existing debt, the probate court can most likely refuse to consider your petition. However, Florida law allows for many types of evidence to prove a debt, so contact a Florida probate attorney for assistance if you are unsure of the supporting evidence for your claim.

Fill out the Claim Form

Claim forms may be available online in some counties, but the format for forms can change, so if you are using an online form, make sure it is the latest edition and tailored for the specific jurisdiction where it will be filed. Some probate courts mighty need you to file your claim in person at the courthouse. Others will let you file your claim either online or by mail.

Although each probate court’s form is slightly different, they all require the exact details, such as the probate case number and your details. This form would also enable you to confirm your debts, which is why you should have supporting documents, as stated above.

Keep in mind that if the evidence of the original debt is insufficient, you would still need to show the debtor did not settle the loan in full before his or her death.

The form might need you to explain the debt. For example, if the debt is a loan, you can clarify what kind of loan you put out—personal, residential, or car.

When you’ve finished filling out the form, it’s time to send it to the probate court. Depending on the case’s rules, you can file online, by post, or in person. Once you make the petition, get a signed copy for your records because it gives you access to the estate’s files.

What Is the Deadline for Filing A Creditor Claim in Florida Probate?

- 30 days from the receipt of the notice to creditors

- Three months after the first release of the notice to creditors

- Two years from death for proven or reasonably ascertainable creditors who missed the notice to creditors

The deadlines are into two categories: those that apply to known or reasonably ascertainable lenders and those that apply to unidentified creditors.

Unknown Creditor Claim Deadline—3 Months from First Publication

If you are not a proven or reasonably ascertainable creditor, the law requires that an attempt is made to give notice to creditors. Sufficient notice is usually accomplished through the publication of notice in a local newspaper.

The limitation period applicable to unknown creditors, outlined in section 733.702(1), begins with the publication date of the notice to creditors and ends three months after the first publication date.

Creditor Claim Deadlines—Up to Two Years for Known or Reasonably Ascertainable Creditors

You have the right to a direct notification of a Florida probate proceeding if you are a proven or reasonably ascertainable creditor.

How Can I Object A Claim in Probate?

A personal representative or another interested party may file a written objection to a claim within four months of the first publication of notice to creditors or within 30 days of the timely filing of an amendment to the claim, whichever comes first.

If a creditor makes a claim, the Personal Representative (and every other involved party) may assess the merits and decide whether to object to the claim. According to Florida Statutes Section 733.705 (2), you may object to a claim:

- If an objection is filed, Florida Probate Rules require the person who files it to serve a copy of the objection.

- If an objection is not served with a copy, it is considered abandoned.

- If there is a good reason, the court may grant an extension of time to file or serve an objection to any claim.

An interesting thing to note is that either the Personal Representative or another interested party may submit the objection. For example, even though the Personal Representative does not object to the claim, a beneficiary can.

Where someone other than the Personal Representative brings an objection, the Personal Representative can petition the court for an order absolving them of the duty to defend the estate. If you are the Personal Representative or Administrator for an estate, you may feel overwhelmed if the probate process becomes complicated. Contact the Lopez Law Group for a consultation to clarify your duties and an honest assessment of how we can help resolve issues surrounding the estate.

What Happens If A Creditor Files A Claim to Which an Interested Party Objects?

The claimant has 30 days from notice of an objection to bring an independent action against the claim. To put it another way, the creditor must sue to establish the claim. For a good reason, the court may extend the time for bringing legal action after filing an objection.

After 30 days, no action or proceeding on the claim may be brought against the Personal Representative, and the claim is barred without a court order unless an extension is granted.

If a decedent owes you money in Florida or you’re disputing a lawsuit, consult with Lopez Law Group on how you will be compensated. The time period for filing a claim varies depending on the situation, so don’t put off contacting a Florida attorney.

Call Lopez Law Group as soon as you realize you have a creditor’s claim. Florida probate laws are complex, and you may not have much time to respond. We will provide you with an in-depth consultation to determine how to proceed and collect the money you are owed from the estate.

Our Expertise

- Business Lawyers

- Residential Real Estate Lawyers

- Commercial Real Estate Lawyers

- DUI Lawyers in Florida

- Expunction and Sealing Lawyers

- Florida Clemency

- Injunction Lawyers

- Tenant Lawyers

- Landlord Lawyers

- HOA Lawyers

- Defamation Lawyers

- Eviction Attorneys

- Moving Company Dispute Lawyers

- Probate Lawyers in Florida

What Our Clients Say

A Godsend

Mr. Lopez was a Godsend and really helped me with my situation. Him and the entire firm were very diligent and helped speed the early stages of the process along due to a pressing situation. Throughout my experience working with the firm, they were always responsive and available any time I had a question or wanted to check on the state of affairs. Hopefully I won’t have to recommend Lopez Law Group to my friends or family, but if those unfortunate circumstances arise then there’s only one name I would trust. Thank you again for all your help!

Lopez Law Group Can See You Through Cases Like:

Don't See What You Need?

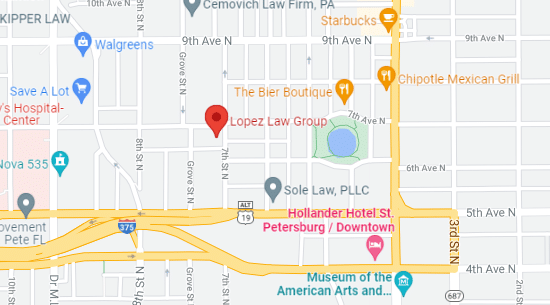

Lopez Law Group

700 7th Ave N, Suite A,

St. Petersburg, FL 33701

P: 727-933-0015

Business Hours

Mo, Tu, We, Th, Fr

Schedule a Call Back

Book a Consultation