Unpaid or Overtime Wages Disputes in Florida

Florida Attorneys

Serving You and The State of Florida

Whether they are aware of it or not, most workers have been cheated out of wages which they have earned and deserve at some point. Employers who refuse to pay minimum wage or overtime premiums are common and the problem only continues to grow.

Withholding employees’ rightfully earned dollars is wage theft, yet many employees are unaware that it is an issue, so normalized has the practice become. If you have experienced wage theft in Florida, you may be entitled to back pay and additional compensation.

Minimum Wage and Overtime Laws in Florida

The federal Fair Labor Standards Act (FLSA) and Florida state laws guarantee certain workers the right to a minimum wage and overtime premiums.

In Florida, workers are classed into three categories that determine which labor laws apply to them. The categories are independent contractors, exempt employees, and non-exempt employees.

Independent contractors are not considered employees, so they are not guaranteed wage and overtime protections under the law.

Overtime exempt employees tend to be business and administrative executives with some control over their hours. Exempt employees are not guaranteed overtime pay for hours worked outside of their regular 40-hour workweek.

To be considered an exempt employee, workers must meet specific criteria. To be considered exempt, employees must earn at least $455 per week on a salaried basis. Contrary to popular belief, salaried employees are not automatically exempt from overtime pay. If you are salaried but end up working above 40 hours per week, you may be entitled to overtime premiums based on your employment type.

Additional requirements for overtime exemption depend on the type of position held. Requirements for some exempt employees include:

- Executive. Employees with managerial duties, including hiring and firing authority, are often exempt from overtime laws.

- Administrative. Administrative employees who perform office work pertaining to daily business operations and management fall into the exempt category.

- Professional. The FLSA classifies both learned and creative professionals as exempt employees. Exempt professionals tend to have extensive knowledge of a particular field.

Non-exempt employees are entitled to overtime premiums.

Overtime Laws

Florida has no overtime laws of its own and defers to federal overtime law instead.

Overtime rates in Florida follow the FLSA, which dictates that employees must be paid at one and a half times their regular rate for overtime hours. Employers are required to pay overtime premiums to employees who work over 10 hours a day or over 40 hours a week.

Minimum Wage Laws

Florida’s minimum wage is $8.56 hourly, which is higher than the federal minimum wage of $7.25 per hour. The minimum wage is re-evaluated each year and is written into Florida’s constitution.

In Florida, employers have the option to reduce the wage they pay to employees who earn tips. The minimum wage for tipped employees would be $5.63 if the sum of the wages and tips combined equals at least $8.56 an hour. Florida laws do not prohibit voluntary or involuntary tip pooling and sharing.

Meal and Break Requirements

In Florida, employees aged 17 or younger must be allowed a 30-minute break for every four hours consecutively worked. Florida has no meal and break requirements for employees over 18.

However, if your employer chooses to offer breaks throughout the day, but you end up working through your breaks, you are entitled to payment for those hours.

If you work through breaks, be sure to keep track of the hours you worked. The hours you worked in break time may add up to over 40 hours per week, in which case you will be entitled to overtime pay.

Workplace Retaliation Laws in Florida

Workplace retaliation occurs when an employer retaliates against an employee who files a complaint against them or engages in another protected act. Typical forms of retaliation include cutting an employee’s hours or wages without explanation, demotion, wrongful termination, and in some cases, harassment.

In Florida, employees are protected from workplace retaliation under the Florida Civil Rights Act. If an employee experiences adverse action from an employer after filing a complaint, they may be entitled to compensation if they cannot come to an agreement with their employer.

Common Wage Violations

Unfortunately, wage violations aren’t always blatant. Employers have subtle ways of duping their employees out of the wages they rightly deserve. Common tactics employers use to avoid paying overtime premiums include:

- Asking employees to perform certain tasks off the clock

- Adding overtime exemption clauses to employment contracts

- Wrongfully classing non-exempt workers as exempt workers

Other wage violations include:

- Illegally deducting from workers’ pay

- Refusing to pay employees minimum wage

- Stealing tips

- Unpaid commissions and bonuses

- Failure to provide employees with vacation time they rightly earned

- Retaliating against employees who report workplace violations

All of the above tactics are illegal and considered wage theft.

One of the most overlooked types of wage theft is requiring employees to show up early for work but not paying them for that time. Most employees are unaware that this is illegal. If you are asked to show up 15 minutes early for your shift, your employer is legally required to pay you for that time regardless of whether you are clocked in.

Who Experiences Wage Violations?

Wage theft affects the people who can least afford it. Wage theft victims are often minimum and low-wage workers. Studies show that minimum wage violations affect 17 percent of low-wage workers in all demographics. In Florida, nearly 25% of low-wage workers experience wage theft.

Why is Wage Theft So Common?

Wage theft is one of the most common forms of theft in the United States. A 2017 Economic Policy Institute (EPI) study of ten states found that roughly 2.4 million people lose a combined $8 billion to wage theft each year, nearly half of all property theft combined.

The EPI estimates that total wage theft in the United States amounts to roughly $15 billion each year. Wage theft is illegal, so why do employers keep getting away with it?

Going up against an employer is tough. Litigation processes are lengthy, and most low wage workers don’t have the time or resources needed to file a successful wage theft claim, leading many of them to forego pursuing compensation altogether.

Another reason employees do not come forward with wage disputes is for fear of losing their job. Most low-wage workers live paycheck to paycheck and can’t risk losing income for even a short period. Although retaliation from employers is illegal, it happens all too often to employees who don’t have the resources to fight against it.

Unfortunately, 2018 saw the Supreme Court add another hurdle for employees experiencing wage violations. Epic Systems Corp. vs. Lewis’s decision ruled that employers can legally require employees to sign away their rights to join class-action lawsuits, making it even harder for employees to receive the owed wages.

What Can I Do About Unpaid Wages and Overtime?

Under federal and state law, employees are entitled to collect penalties and recover lost wages from employers who refuse to pay them.

If your employer violates minimum wage law, you can file for liquidated damages. Liquidated damages are equal to your unpaid wages. If your employer owes you in unpaid minimum wages, you are entitled to the same amount in liquidated damages.

To file a claim under the Florida Minimum Wage Statute, you must follow certain steps. If you wish to claim liquidated damages, you must first notify your employer of your plans to sue. You must provide your employer with the exact wages you should have been paid, detailing the exact days and hours you worked. Your employer must then resolve the issue within 15 calendar days. If they fail or refuse to pay you what they owe, you can then file for liquidated damages.

Overtime pay works similarly. If your employer fails to pay you overtime premiums, you are entitled to the unpaid wages they owe you and the same amount in liquidated damages.

If the employer loses the lawsuit, they may be required to cover the employee’s attorney fees and other legal expenses.

Do I Need to File a Lawsuit?

Florida does not have its own agency that handles wage complaints. If employees wish to dispute wages or overtime pay, they can file a complaint with the federal Department of Labor or file a lawsuit.

In Florida, employees have four years to file a lawsuit against employers who owe them wages. If your employer willfully refused to pay you, you have up to five years to make a claim.

Under federal law, employees have two years from the date of the wage violation to file an administrative claim or sue their employer. If the employer willfully violated wage laws, employees have three years to file claims or sue.

If you file a claim under federal law, you do not need to notify your employer of your plans to sue beforehand; however, you will not be eligible to receive liquidated damages.

Do I Need a Lawyer?

While you can opt to file a dispute with the Department of Labor, note that the agency is often swimming in complaints, and your case may be put on the backburner for several months.

The process can be grueling, and you will have to learn the ins and outs of employment law to ensure you aren’t cheated out of adequate compensation. Hiring an attorney to handle your unpaid wage or overtime case is the quickest way to retrieve unpaid wages and damages.

If you believe you have a strong case against your employer, hiring an attorney is well worth it, as your employer will likely have to cover your legal costs if you win your case.

An experienced employment lawyer can help you build a strong case against your employer. They will also be able to explain any other options you may have, such as a breach of contract claim. A knowledgeable attorney will understand the types of compensation to which you are entitled and can help you understand the best way to pursue your unpaid wages case.

How Long Will My Case Take?

Wage dispute claims can take up to two years to resolve. However, there are ways to accelerate the process. If you decide to take on a wage dispute claim independently, it will likely take longer to resolve. An attorney well-versed in labor laws can navigate a wage dispute case quicker and with much more ease. If possible, hiring an attorney is always the best way to recover stolen wages.

Let Us Handle Your Overtime or Unpaid Wage Dispute

Going up against your employer isn’t easy. If your employer is withholding your wages or overtime payment, contact us today for a case review. The lawyers at the Lopez Law Group are ready to evaluate your claim and fight to recover the wages you rightfully earned. Call us at (727) 933-0115 today.

Our Expertise

- Business Lawyers

- Residential Real Estate Lawyers

- Commercial Real Estate Lawyers

- DUI Lawyers in Florida

- Expunction and Sealing Lawyers

- Florida Clemency

- Injunction Lawyers

- Tenant Lawyers

- Landlord Lawyers

- HOA Lawyers

- Defamation Lawyers

- Eviction Attorneys

- Moving Company Dispute Lawyers

- Probate Lawyers in Florida

What Our Clients Say

A Godsend

Mr. Lopez was a Godsend and really helped me with my situation. Him and the entire firm were very diligent and helped speed the early stages of the process along due to a pressing situation. Throughout my experience working with the firm, they were always responsive and available any time I had a question or wanted to check on the state of affairs. Hopefully I won’t have to recommend Lopez Law Group to my friends or family, but if those unfortunate circumstances arise then there’s only one name I would trust. Thank you again for all your help!

Lopez Law Group Can See You Through Cases Like:

Don't See What You Need?

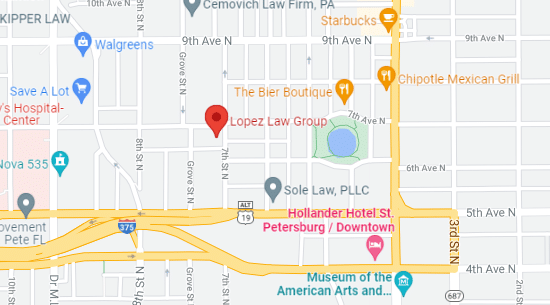

Lopez Law Group

700 7th Ave N, Suite A,

St. Petersburg, FL 33701

P: 727-933-0015

Business Hours

Mo, Tu, We, Th, Fr

Schedule a Call Back

Book a Consultation