Hurricane Damage Claims In Florida

Florida Attorneys

Serving You and The State of Florida

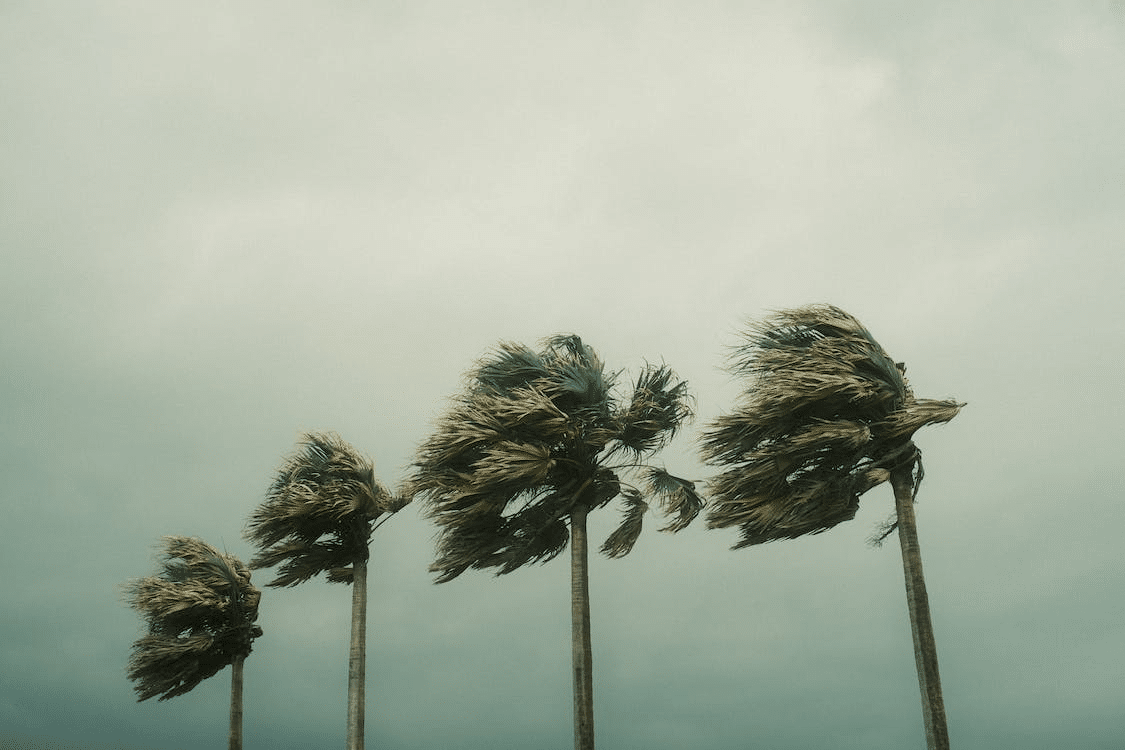

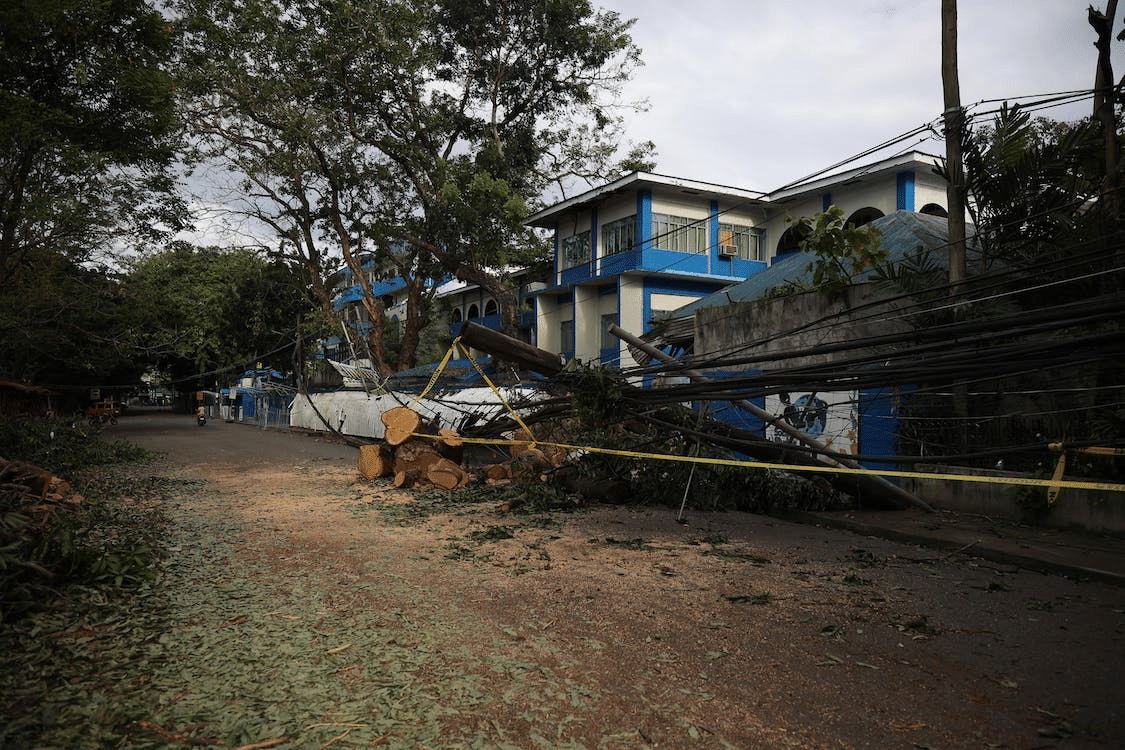

Hurricane claims are becoming an increasingly common thing for Florida homeowners to need to file. The storm seasons of the past five years have been very intense in Florida, and many homeowners were not ready to file claims for storm damage to their property.

Knowing more about how Hurricane damage claims work in the state of Florida can have a big impact on homeowners’ ability to get claims filed and paid out as soon as possible. You might also need to consider securing the support of skilled legal counsel if you are having trouble getting your hurricane damage claim paid on.

The team at Lopez Law has years of experience working on hurricane damage claims and can help you to secure the settlement amount or claims payout that you deserve. Getting our clients back on their feet after natural disasters is a point of pride for Lopez Law.

How Do Hurricane Damage Claims Work in Florida?

Many Florida property owners are unaware that Florida’s homeowner’s insurance policies have a separate deductible that covers damages related to hurricanes and tropical storms. This is because the cost of damages related to these kinds of events is often quite high. This means that your deductible will typically be higher for this portion of your policy than other kinds of damage claims that are not related to storm activity.

Florida law is very specific with regard to the way that hurricane claims are processed and paid. Homeowners’ insurance policies will not allow you to use your hurricane coverage over and over during a calendar year. In most cases, this part of your policy will be limited to use during certain months of the year, and set claims details will be required in order for your claim to be processed.

Additionally, you will have one year to file your claim with your insurance. This prevents homeowners from filing claims for lots of added damage that is not related to the original storm event. You might have been told that the timeframe for sending in a hurricane claim is 2-3 years, but that is the timeframe for other homeowner’s claims under most policies. Since hurricane damage can happen on an annual basis in the state of Florida, insurance companies will not allow you to wait more than a year to file a claim.

It can be very hard to fight insurance companies on this point. If you have waited too long to file your homeowners’ insurance claim, you might not be able to rectify this issue. However, the team at Lopez Law will be happy to go to bat for you to try and get your homeowners’ insurance policy to pay out on your claim. In some cases, errors on the part of the insurance company and other issues can lead to appeals for these kinds of denials being possible.

What Constitutes Storm Damage in the State of Florida?

If you are not sure what hurricane damage is defined as in the state of Florida, you are not alone. It can be confusing to figure out the difference between flood damage, storm damage, and hurricane damage. However, there are some basic conditions that have to be met for homeowners to be able to access the hurricane damage part of their policy.

A hurricane is defined as a storm system that has been declared a hurricane by the National Hurricane Center of the National Weather Service. The kind of damage that could be caused by any kind of storm might include flooding, damage to your roof or other structures on the property, and things like sleet or hail damage. However, if the storm has not been declared a hurricane, the hurricane coverage on a homeowner’s policy will not be used to pay out on the claim.

When Does the Hurricane Deductible Apply?

According to Florida state law, the hurricane deductible applies as soon as the hurricane warning or the notification that a storm has been classified as a hurricane is sent out to the public. This begins the countdown until the storm arrives, and it also defines how homeowners’ policies will tackle claims for damage during the time that the storm is active.

The hurricane deductible will cease to apply to new claims that are filed 72 hours after the termination of the hurricane or hurricane watch and are not related to the events of the storm. This can be very complicated to determine in the days and weeks after a storm, so adjusters have to make judgment calls about which claims are related to which kinds of damage. This can cause problems with the payout of settlements and issues with payouts on claims damages.

Having a lawyer helping you with the process of submitting and filing your claim is key. You will need to make sure that a skilled expert is reviewing the information that was submitted with your claim and that the timelines for the damage are correctly documented as well. This can have a big impact on the amount of deductible that you will pay for your storm-related damage, and it can also have an effect on how much money you are able to receive for the damages associated with the event.

When you try and go it alone with regard to storm damage claims, things can get very confusing very rapidly. Insurance companies are often quite overwhelmed during the lead-up to a storm and the aftermath of the storm’s visit to the state of Florida. You do not want your claim to get lost in the shuffle or be denied in error due to documentation errors or confusion with your adjustor.

While insurance companies do not typically act in bad faith, it is possible for an adjuster to attempt to save the company money by denying a claim that should not have been denied. You will need to make sure that you secure a skilled legal expert to work on your claims case if you think that a bad faith denial is involved in your claims process. The team at Lopez Law can help you sort out and fix issues related to this kind of denial so that you are not required to try and come up with the money to repair your home out of pocket.

What Are the Hurricane Deductible Options on Homeowner’s Insurance Policies?

In many cases, the hurricane deductible in the state of Florida is $500 plus 2, 5, or 10% of the dwelling or structure limits. This amount will be listed as a dollar amount even if the policy language states the percentage of the deductible when describing how the policy works. There are some exceptions to this policy, which are as follows:

- Homes That Are Insured for $100,000-$249,999

These homes will not be offered the $500 deductible policy and, in most cases, will simply be offered a policy that will not be non-renewed even if there is a hurricane loss each year. The usual deductible for these policies is 2%.

- Dwellings Insured for $250,000 or more:

These homes will be offered a policy that has a $500 deductible in most cases. However, you might also be offered the chance to select from the 2, 5, or 10% options for the remainder of the deductible amount if you need to use this part of your policy.

- Dwellings Insured for less than $500,000:

These homes will be offered a hurricane deductible in excess of 10% unless the homeowner agrees in writing to cover a set portion of the amount of the costs of repairs related to a hurricane. The insured might also be required to prove that there is a mortgage or a lien on the property, which will then be used to indicate that the mortgagee approves of other deductible choices that are lower than 10%.

- Dwellings that are in excess of $1 to 3 million dollars:

These policies will often be offered 3, 5, and 10% deductible options in lieu of the usual 2, 5, and 10 percent choices. Most companies will only offer 5 and 10% to homeowners of properties that are in excess of $3 million.

Homeowners will be relieved to know that no other deductibles will be applied in the case that there is a need to access the hurricane coverage on a policy. This means that the total amount of the deductible that you will have to pay is linked directly to the hurricane coverage on your policy. All of the other possible coverages will typically not come into play when it comes to hurricane damage.

What Happens if There is a Second Hurricane in a Year in Florida?

There are many years when homeowners might be impacted by more than one hurricane. If there is another hurricane in a calendar year that requires that claims are made on homeowners’ insurance policies, the following will take place:

- The deductible for the second storm will be the amount left over from the first hurricane deductible if the other deductible was not fully met.

- The “all other peril” cost will become the deductible as stated in the unique policy that a policyholder has taken out.

All other peril is a clause that is part of the regular homeowners’ insurance policy to cover unspecified damages that are not related to things like fires or other kinds of covered damages that can happen to a home. This is not part of the hurricane coverage, but there is an extension that is made within the policy to cover this second storm without violating the language and terms of the homeowners’ policy hurricane coverage.

This situation is not very common, but it can happen during some hurricane seasons. There are sometimes errors that are made on the side of the insurance company related to accessing this coverage. Once you know that you are going to have to file a second hurricane claim in a given season, you will need to be sure that you also speak with a legal expert.

Having a lawyer working on your claims process can make all the difference when it comes to unique situations like secondary hurricane claims in the same season. You will find that you also will be less stressed and worried if you are allowing a legal expert to talk to the insurance company about the proper deductibles and coverage limitations related to this unique situation.

You should always file a claim when your property has suffered damage related to a storm of this kind. It can be very hard to fight an insurance company if you do not actually file your claim in a timely manner. Denials can usually be appealed, however, so it is important to at least have documentation on file of your claim.

What Are Surplus Lines Companies?

There are two kinds of insurance companies. One kind if the Authorized Insurer. This insurance company can write business via the Florida Office of Insurance Regulation with a certificate of authority. These insurance companies have to submit their rates to the OIR to be approved each year. The policyholder of this kind of insurance policy has protection under the Florida Insurance Guaranty Fund, FIGA. This is important in case an insurance company becomes insolvent.

Surplus Lines companies and coverage is not backed by the same protections. These companies can write policies without submitting their rates and policy information to FIGA. This means that FIGA will not cover losses suffered under these policies if the insurance company becomes insolvent.

With the increasing rate of hurricane and storm damage issues in the state of Florida and the necessity to pay out on increasingly costly claims, many insurance companies in the state of Florida have gone out of business recently. This is why having a FIGA-covered, authorized insurer handling your policy is key.

If you have filed a claim with a surplus lines company and have been denied coverage or the company has become insolvent, you will need the help of a legal expert right away. Time is of the essence when it comes to these kinds of claims because the longer that you wait around to try and contest this kind of denial or non-payment issue, the less likely it will be that you will receive the amount that you are owed for your claims.

What is Inflation Guard?

Inflation Guard is an endorsement that can be added to insurance policies that cover homes in the state of Florida. This endorsement is in place to provide for increases to policy limits over time. Inflation Guard keeps your coverage at an affordable rate so that you do not have to pay changing homeowners’ insurance costs each policy cycle.

This coverage can also help to keep deductible amounts stable even during busy storm seasons. The more protections that you can have in place as a policyholder, the better when it comes to storm and hurricane coverage. There are few states that are so uniquely affected by this kind of damage each year. Being protected against a major loss that is not paid out in full is key if you are going to purchase property in the state of Florida.

Even if you have Inflation Guard on your policy, it can be very expensive to have homeowner’s coverage in the state of Florida. This is why it is very unfair for insurance companies to incorrectly deny claims for this kind of damage. In many cases, Inflation Guard is actually a benefit to the insurance company as well, so there is no reason for them to deny a claim just because it is a large one.

Can Insurance Companies Deny Hurricane Coverage Claims?

Hurricane coverage claims can be denied for a few reasons. The most common reason that a claim of this kind is denied is due to a lack of communication from the person who placed the claim or incorrect information being entered in the claim details. This kind of denial is often very easy to rectify. Lopez Law can help you to clear up claims misunderstandings that have led to nonpayment so that you can get the money you need to repair your home.

If the insurance company finds that you have waited more than a year to submit a hurricane damage claim or you have submitted more than two claims of this kind in a year, your claim will be denied. Additionally, any damage that is related to neglect of the home after the original storm event will not be paid out on. This is because homeowners have a responsibility in the state of Florida to make sure that they take action to halt the spread of water and mold while they are waiting for their claim to be paid.

Lopez Law can offer clients the information needed to contact companies that provide this kind of support when a disaster has happened. While it is an added cost associated with severe damage to your home, this step is often essential if you want to get a fair and complete claim payout from your insurance company. It can also be very hard to return your home to a livable condition if there has been no effort to check the spread of water damage, mold, and issues with structural instability.

What Are the Common Tactics Insurance Companies Use to Deny Claims

There are some common tactics that can be associated with incorrect claims denials. Homeowners should consider these statements or explanations red flags that there are issues with their claims process that require the help of a legal expert.

If your claim is denied and the adjustor suggests that you get an attorney, or the insurance company has repeatedly offered you lowball claims settlement offers, these are signs that something is wrong with the claims process. Delays in processing, adjusting, or paying out on claims can also fall into this category.

If the company states that you do not have hurricane coverage, but you know that you do, or they require a signed release before paying out on a claim, it is also time to get a lawyer to represent you. Exclusions and limitations that you think do not apply can also be related to incorrect claims denials as well.

If you think that something is wrong with the way that your claim is being adjusted, you need to be sure that you secure a legal expert to help you with your claim. Waiting until your claim has been denied fully or for incorrect reasons only wastes time and allows the insurance company to place your claim at the back of the line of the appeals process.

The team at Lopez Law has years of experience fighting these kinds of tactics and can help you to get your claim appealed successfully. There is no excuse for insurance companies refusing to do their job as it relates to the claims process. We are happy to get involved and ensure that you are paid correctly for the damages that need to be repaired on your property.

What Can a Florida Legal Team Do for Hurricane Claims?

Involving a lawyer in your homeowner’s claim process can be a great idea. Hurricane claims are governed by many laws and specifics and can be quite complex to adjudicate. Insurance companies can make mistakes or be unwilling to pay out on claims that are quite large in size. It can also be very stressful to have to handle the claims process on top of caring for your family after a hurricane has damaged your home and property.

The team at Lopez Law can help you get the claims settlement or payout that you deserve. We have the years of experience that you need to help make your hurricane claim process simple and straightforward. If you have received a denial or are just starting the claims process, the team at Lopez Law can help. We make sure that our clients are not left hanging when they have suffered losses as a result of hurricane and storm damage.

Related:

Our Expertise

- Business Lawyers

- Residential Real Estate Lawyers

- Commercial Real Estate Lawyers

- DUI Lawyers in Florida

- Expunction and Sealing Lawyers

- Florida Clemency

- Injunction Lawyers

- Tenant Lawyers

- Landlord Lawyers

- HOA Lawyers

- Defamation Lawyers

- Eviction Attorneys

- Moving Company Dispute Lawyers

- Probate Lawyers in Florida

What Our Clients Say

A Godsend

Mr. Lopez was a Godsend and really helped me with my situation. Him and the entire firm were very diligent and helped speed the early stages of the process along due to a pressing situation. Throughout my experience working with the firm, they were always responsive and available any time I had a question or wanted to check on the state of affairs. Hopefully I won’t have to recommend Lopez Law Group to my friends or family, but if those unfortunate circumstances arise then there’s only one name I would trust. Thank you again for all your help!

Lopez Law Group Can See You Through Cases Like:

Don't See What You Need?

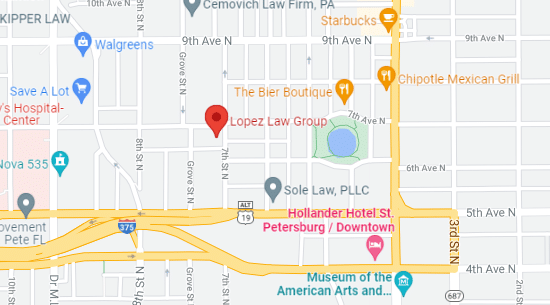

Lopez Law Group

700 7th Ave N, Suite A,

St. Petersburg, FL 33701

P: 727-933-0015

Business Hours

Mo, Tu, We, Th, Fr

Schedule a Call Back

Book a Consultation